Gym Equipment Gst Rate 2022 . india has a fixed gst (goods and service tax) rate that is broken down into five tax rate slabs: In sync with services, gym equipment also falls under the 18% gst rate category. discover gst rates & hsn code 9506 for exercise equipment. gst rates and classification of certain goods and services in light of industry representations and existing ambiguity. Gst rates and hsn code for exercise equipment. 0%, 5%, 12%, 18%, and 28%. 107 rows articles and equipment for general physical exercise, gymnastics, athletics, other sports (including tabletennis) or out. 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and equipment for general. Stay informed on taxation for fitness gear. unveiling the gst rate on gym equipment: Check out the complete list of goods and.

from blog.saginfotech.com

india has a fixed gst (goods and service tax) rate that is broken down into five tax rate slabs: 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and equipment for general. 107 rows articles and equipment for general physical exercise, gymnastics, athletics, other sports (including tabletennis) or out. Gst rates and hsn code for exercise equipment. gst rates and classification of certain goods and services in light of industry representations and existing ambiguity. In sync with services, gym equipment also falls under the 18% gst rate category. Stay informed on taxation for fitness gear. discover gst rates & hsn code 9506 for exercise equipment. unveiling the gst rate on gym equipment: 0%, 5%, 12%, 18%, and 28%.

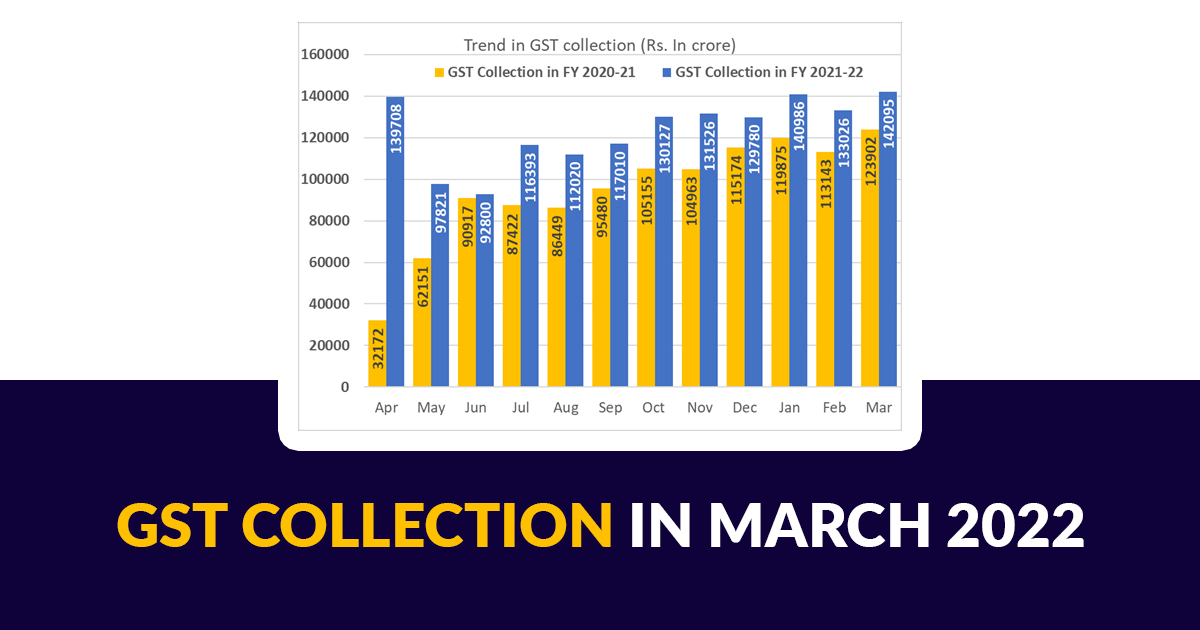

AllTime High GST Collection Hits 1.42 Lakh Crore in Mar 2022

Gym Equipment Gst Rate 2022 india has a fixed gst (goods and service tax) rate that is broken down into five tax rate slabs: Stay informed on taxation for fitness gear. discover gst rates & hsn code 9506 for exercise equipment. Gst rates and hsn code for exercise equipment. In sync with services, gym equipment also falls under the 18% gst rate category. india has a fixed gst (goods and service tax) rate that is broken down into five tax rate slabs: 107 rows articles and equipment for general physical exercise, gymnastics, athletics, other sports (including tabletennis) or out. 0%, 5%, 12%, 18%, and 28%. unveiling the gst rate on gym equipment: gst rates and classification of certain goods and services in light of industry representations and existing ambiguity. 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and equipment for general. Check out the complete list of goods and.

From www.youtube.com

New GST Rates 2022 Check What is Costlier, What is Cheaper? YouTube Gym Equipment Gst Rate 2022 Stay informed on taxation for fitness gear. Gst rates and hsn code for exercise equipment. Check out the complete list of goods and. 0%, 5%, 12%, 18%, and 28%. india has a fixed gst (goods and service tax) rate that is broken down into five tax rate slabs: In sync with services, gym equipment also falls under the 18%. Gym Equipment Gst Rate 2022.

From geod.in

New GST Rate List 2022 PDF Download नई जीएसटी दर सूची 2022 पीडीएफ Gym Equipment Gst Rate 2022 107 rows articles and equipment for general physical exercise, gymnastics, athletics, other sports (including tabletennis) or out. 0%, 5%, 12%, 18%, and 28%. 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and equipment for general. discover gst rates & hsn code 9506 for exercise equipment. Stay. Gym Equipment Gst Rate 2022.

From finsights.biz

All Major GST Changes in 2022 with Details Finsights Gym Equipment Gst Rate 2022 Stay informed on taxation for fitness gear. discover gst rates & hsn code 9506 for exercise equipment. 0%, 5%, 12%, 18%, and 28%. Check out the complete list of goods and. 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and equipment for general. unveiling the gst. Gym Equipment Gst Rate 2022.

From instafiling.com

HSN Code List and GST Rates 2022 (Updated) Gym Equipment Gst Rate 2022 discover gst rates & hsn code 9506 for exercise equipment. 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and equipment for general. Stay informed on taxation for fitness gear. unveiling the gst rate on gym equipment: Check out the complete list of goods and. 107. Gym Equipment Gst Rate 2022.

From gstsafar.com

GST Rate Changes on goods from 18th July 2022 GSTSafar Gym Equipment Gst Rate 2022 gst rates and classification of certain goods and services in light of industry representations and existing ambiguity. Stay informed on taxation for fitness gear. india has a fixed gst (goods and service tax) rate that is broken down into five tax rate slabs: 52 rows get all 6 digit and 8 digit codes and their gst rates. Gym Equipment Gst Rate 2022.

From www.vrogue.co

Revised Gst Rates Here S What Cheaper Check F vrogue.co Gym Equipment Gst Rate 2022 Check out the complete list of goods and. unveiling the gst rate on gym equipment: 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and equipment for general. india has a fixed gst (goods and service tax) rate that is broken down into five tax rate slabs:. Gym Equipment Gst Rate 2022.

From www.moneycontrol.com

New GST rates These items will be costlier Gym Equipment Gst Rate 2022 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and equipment for general. Check out the complete list of goods and. india has a fixed gst (goods and service tax) rate that is broken down into five tax rate slabs: In sync with services, gym equipment also falls. Gym Equipment Gst Rate 2022.

From www.caindelhiindia.com

New GST Rates update effective from 18th July 2022 IFCCL Gym Equipment Gst Rate 2022 In sync with services, gym equipment also falls under the 18% gst rate category. discover gst rates & hsn code 9506 for exercise equipment. 0%, 5%, 12%, 18%, and 28%. Gst rates and hsn code for exercise equipment. 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and. Gym Equipment Gst Rate 2022.

From www.jagranjosh.com

New GST Rates 2022 New GST Rates come into effect from July 18 Check Gym Equipment Gst Rate 2022 In sync with services, gym equipment also falls under the 18% gst rate category. Gst rates and hsn code for exercise equipment. Check out the complete list of goods and. Stay informed on taxation for fitness gear. 0%, 5%, 12%, 18%, and 28%. discover gst rates & hsn code 9506 for exercise equipment. india has a fixed gst. Gym Equipment Gst Rate 2022.

From aliciaqstephannie.pages.dev

Calendar Gst Rate Briny Virginie Gym Equipment Gst Rate 2022 0%, 5%, 12%, 18%, and 28%. 107 rows articles and equipment for general physical exercise, gymnastics, athletics, other sports (including tabletennis) or out. 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and equipment for general. india has a fixed gst (goods and service tax) rate that. Gym Equipment Gst Rate 2022.

From www.scribd.com

GST Council 2022 GST Rates 2022 Complete List of Goods and Service Gym Equipment Gst Rate 2022 gst rates and classification of certain goods and services in light of industry representations and existing ambiguity. Check out the complete list of goods and. discover gst rates & hsn code 9506 for exercise equipment. 0%, 5%, 12%, 18%, and 28%. In sync with services, gym equipment also falls under the 18% gst rate category. 52 rows. Gym Equipment Gst Rate 2022.

From instafiling.com

New GST Rates in India 2023 (Item Wise and HSN Code) Gym Equipment Gst Rate 2022 discover gst rates & hsn code 9506 for exercise equipment. india has a fixed gst (goods and service tax) rate that is broken down into five tax rate slabs: Check out the complete list of goods and. Stay informed on taxation for fitness gear. In sync with services, gym equipment also falls under the 18% gst rate category.. Gym Equipment Gst Rate 2022.

From dxorolkto.blob.core.windows.net

Safety Equipment Gst Rate at Michelle Hutchinson blog Gym Equipment Gst Rate 2022 Gst rates and hsn code for exercise equipment. 0%, 5%, 12%, 18%, and 28%. discover gst rates & hsn code 9506 for exercise equipment. 52 rows get all 6 digit and 8 digit codes and their gst rates under hsn code 9506 articles and equipment for general. Stay informed on taxation for fitness gear. 107 rows articles. Gym Equipment Gst Rate 2022.

From gstsafar.com

Latest GST Updates 2022GST Updates December 2022 GST Safar Gym Equipment Gst Rate 2022 0%, 5%, 12%, 18%, and 28%. Stay informed on taxation for fitness gear. In sync with services, gym equipment also falls under the 18% gst rate category. unveiling the gst rate on gym equipment: 107 rows articles and equipment for general physical exercise, gymnastics, athletics, other sports (including tabletennis) or out. Check out the complete list of goods. Gym Equipment Gst Rate 2022.

From blog.saginfotech.com

AllTime High GST Collection Hits 1.42 Lakh Crore in Mar 2022 Gym Equipment Gst Rate 2022 In sync with services, gym equipment also falls under the 18% gst rate category. Stay informed on taxation for fitness gear. gst rates and classification of certain goods and services in light of industry representations and existing ambiguity. Check out the complete list of goods and. discover gst rates & hsn code 9506 for exercise equipment. unveiling. Gym Equipment Gst Rate 2022.

From khatabook.com

GST Rates in 2023 List of GST Rates, Slab and Revision Gym Equipment Gst Rate 2022 0%, 5%, 12%, 18%, and 28%. 107 rows articles and equipment for general physical exercise, gymnastics, athletics, other sports (including tabletennis) or out. Check out the complete list of goods and. gst rates and classification of certain goods and services in light of industry representations and existing ambiguity. Gst rates and hsn code for exercise equipment. 52. Gym Equipment Gst Rate 2022.

From www.taxhelpdesk.in

GST slab rates in India 2022 easily explained TaxHelpdesk Gym Equipment Gst Rate 2022 unveiling the gst rate on gym equipment: Stay informed on taxation for fitness gear. 107 rows articles and equipment for general physical exercise, gymnastics, athletics, other sports (including tabletennis) or out. discover gst rates & hsn code 9506 for exercise equipment. 52 rows get all 6 digit and 8 digit codes and their gst rates under. Gym Equipment Gst Rate 2022.

From dxorolkto.blob.core.windows.net

Safety Equipment Gst Rate at Michelle Hutchinson blog Gym Equipment Gst Rate 2022 0%, 5%, 12%, 18%, and 28%. Gst rates and hsn code for exercise equipment. discover gst rates & hsn code 9506 for exercise equipment. Check out the complete list of goods and. Stay informed on taxation for fitness gear. gst rates and classification of certain goods and services in light of industry representations and existing ambiguity. unveiling. Gym Equipment Gst Rate 2022.